Hydrogen Derivates

Fresh content alert: We are updating our work on Hydrogen applications!

We are updating our work on Hydrogen and there will be an all-new Hydrogen Factsheet! This update will not only include current figures, but will also expand our assessment to the potentials and limitations of key hydrogen derivates, such as ammonia, e-methanol, and synthetic natural gas. Stay tuned for more previews before the release in autumn!

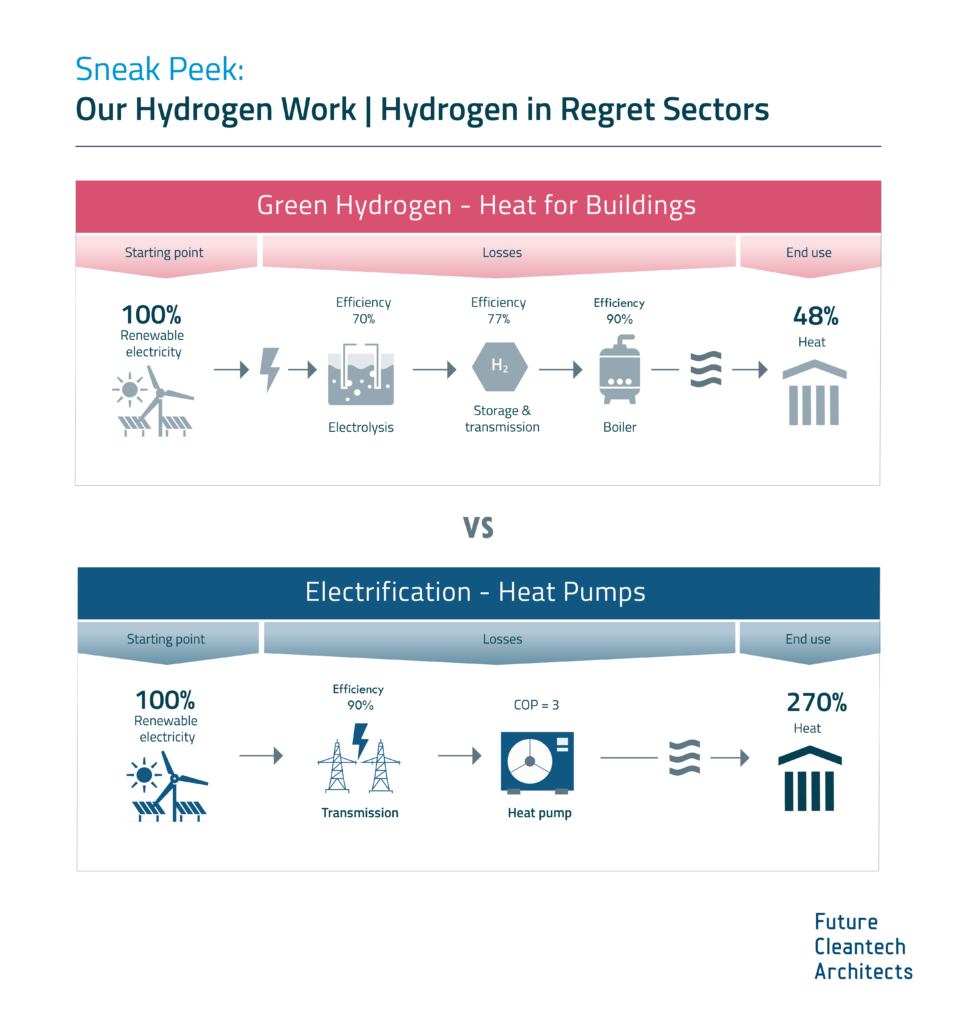

Hydrogen must be prioritized for no-regret sectors as it is a scarce, desperately-needed chemical for several industries.

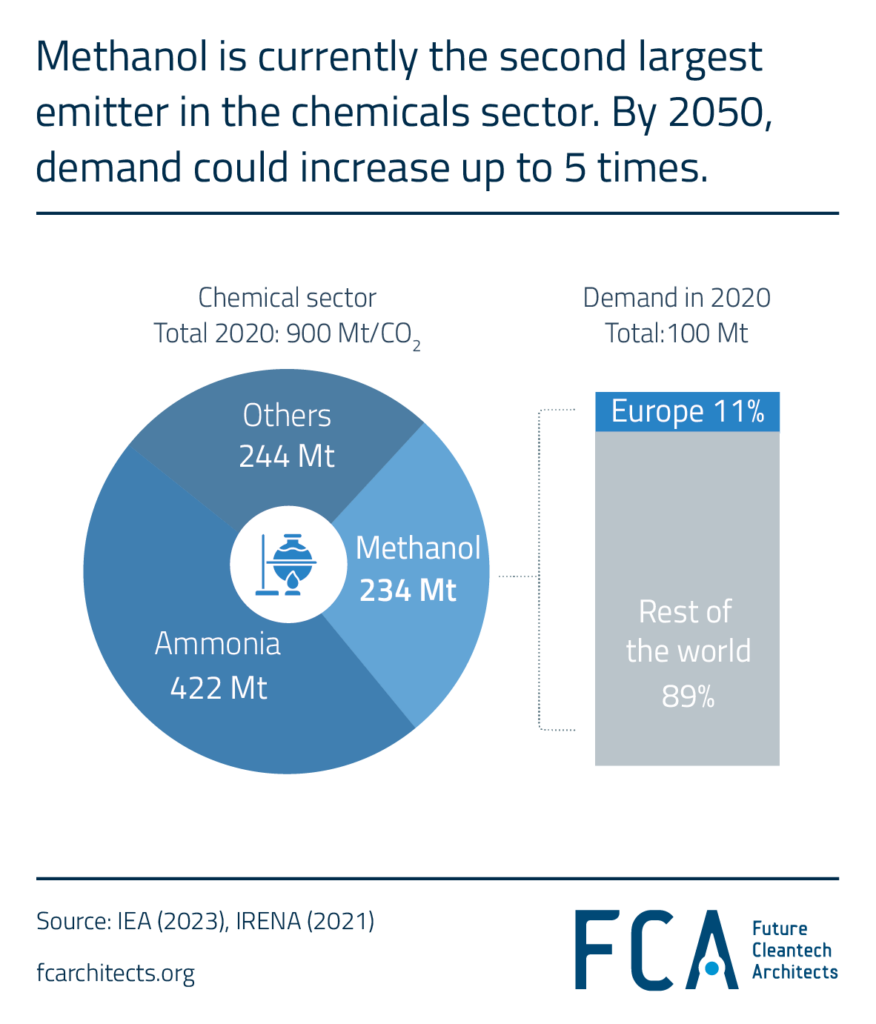

Hydrogen Derivate: Methanol

Methanol is the second largest emitter in the chemical sector, right after ammonia, contributing approximately 0.3 Gt of CO2 emissions on a lifecycle basis. In 2020, global demand for methanol was around 100 Mt. By 2050, this demand could soar to 500 Mt, potentially resulting in significantly larger CO2 emissions. Europe currently consumes about 11.3 Mt of methanol, accounting for roughly 11% of global demand.

Approximately 60% of methanol is used in the chemicals industry, where it serves as a versatile organic feedstock for derivative chemicals and fuels or as a final product across various sectors, including pharmaceuticals, construction, and transport. Methanol is integral to producing everyday items such as plastics, paints, polyester, gloves, and masks. Among its many derivatives, formaldehyde stands out as the most common, being found in glues, dyes, textiles, disinfectants, car parts, and more.

In the EU, methanol is the third-largest consumer of hydrogen, after refining and ammonia production. Hydrogen is a crucial feedstock for methanol synthesis, with approximately 13% of the EU’s hydrogen demand—around 1 Mt/year—dedicated mainly to methanol production in the chemical industry. Of this, Germany accounts for about 22% of hydrogen, consuming roughly 0.22 Mt/year. As methanol demand continues to rise, so too will the demand for hydrogen. However, 99% of methanol production still relies on fossil fuels, primarily through steam methane reforming (SMR) to produce synthesis gas, resulting in significant CO2 emissions. Green hydrogen and sustainable sources of carbon represent less than 1% of the total feedstocks used for methanol production.

Hydrogen Derivate: Ammonia

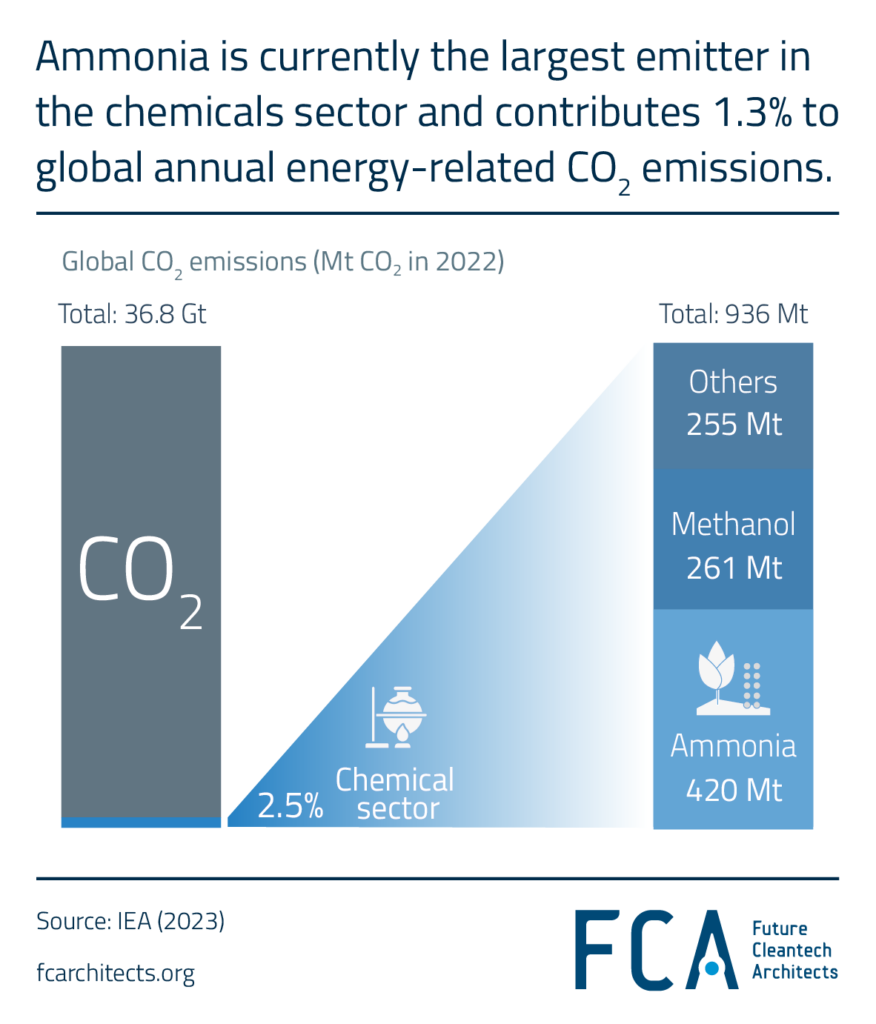

Ammonia is currently the largest emitter in the chemicals sector and contributes 1.3% to global annual energy-related CO2 emissions (i.e., emissions from energy combustion and industrial processes ~34.6 Gt in 2020). Manufacturing ammonia is also a highly carbon-intensive process, with hydrogen being a crucial feedstock in its production. Therefore, eliminating CO2 emissions from the production of ammonia is necessary step on the road to net zero by 2050.

Ammonia is the precursor to most fertilizers, needed by about 50% of the global population to produce food. Currently, 70% of global ammonia demand is for fertilizers. The remaining 30% goes into a range of industrial applications: plastics, explosives, and more. In nearly all ammonia applications, it is used as a precursor to the final products, with only 2% of the ammonia produced being used as the final product.

Green ammonia is chemically identical to conventional ammonia; however, the necessary hydrogen is produced via electrolysis of water powered by renewable electricity. As hydrogen is crucial for ammonia production, one of the priority areas for green hydrogen must be replacing currently used grey hydrogen.

While green ammonia leads to zero direct CO2 emissions, upstream indirect emissions remain. Moreover, it does not eliminate ammonia’s non-CO2 emissions. N2O is a greenhouse gas (GHG) with a warming impact ~300 times greater than that of CO2 and is released during the production of ammonia and the use of nitrogen-based fertilizers.

Finally, all green ammonia use must be prioritized to replace current ammonia produced and consumed before considering the use of green ammonia in novel applications.

Green Ammonia Case Study: Green Ammonia as a Maritime Fuel

Green ammonia is chemically identical to conventional ammonia. While the use of green ammonia itself leads to zero direct CO2 emissions, upstream indirect emissions remain. Moreover, ammonia use has potent non-CO2 emissions. N2O is a greenhouse gas (GHG) with a warming impact ~300 times greater than that of CO2 and is released during the production of ammonia and its end use (for example, during the use of nitrogen-based fertilizers).

Green ammonia produced must first be used to replace the current grey ammonia being consumed before it is considered for additional uses. However, the use of ammonia as an energy carrier rather than a chemical has been garnering more attention, especially for maritime applications.

This attention stems from ammonia having some advantages over hydrogen, including easier liquefaction, higher volumetric energy density, and fewer refueling challenges. Additionally, it is already an internationally traded commodity (though it is toxic to humans and hazardous to the environment) and can be used either directly as a fuel or cracked to produce hydrogen (though the latter incurs a 15% energy loss).

However, the use of Ammonia as maritime fuel comes with a number of challenges. Read them below!

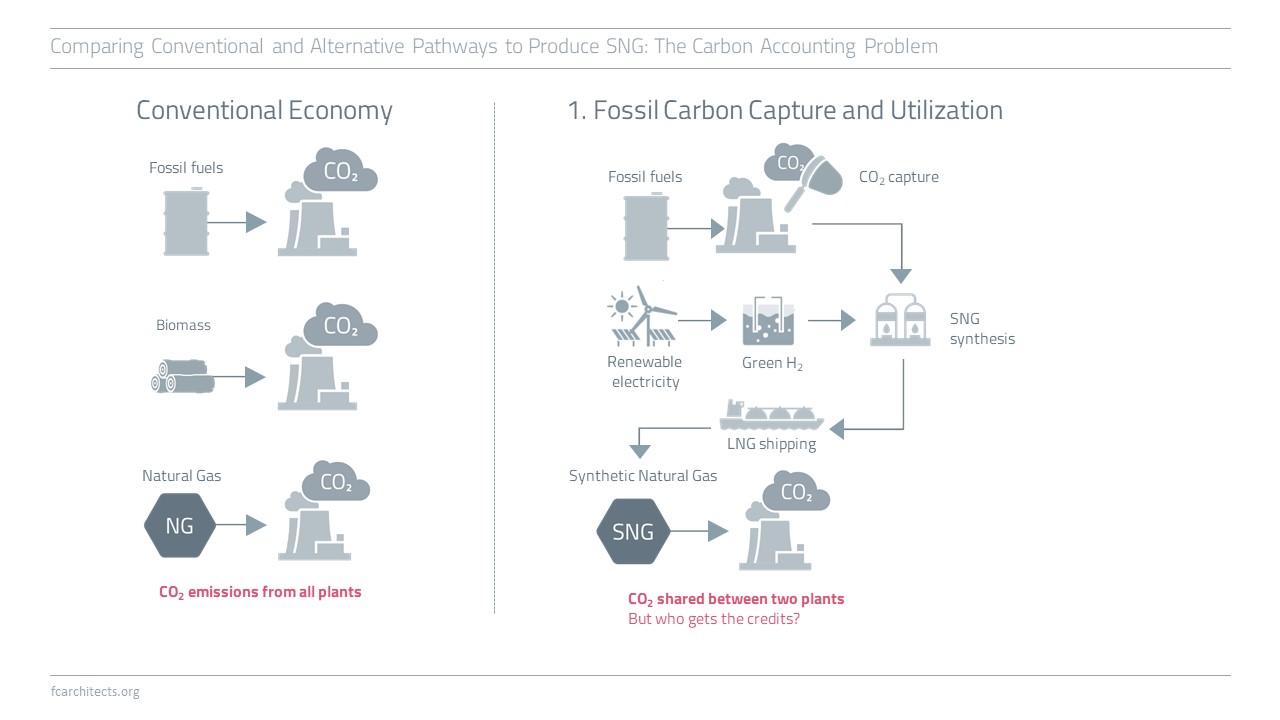

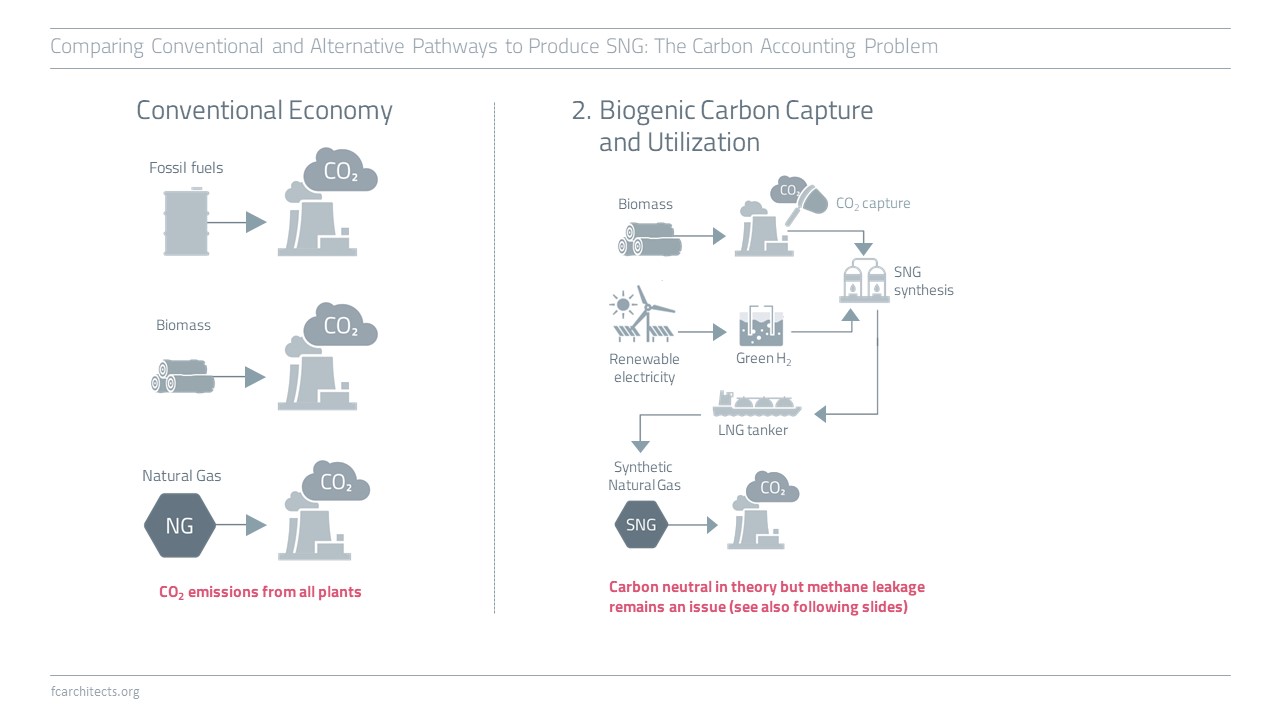

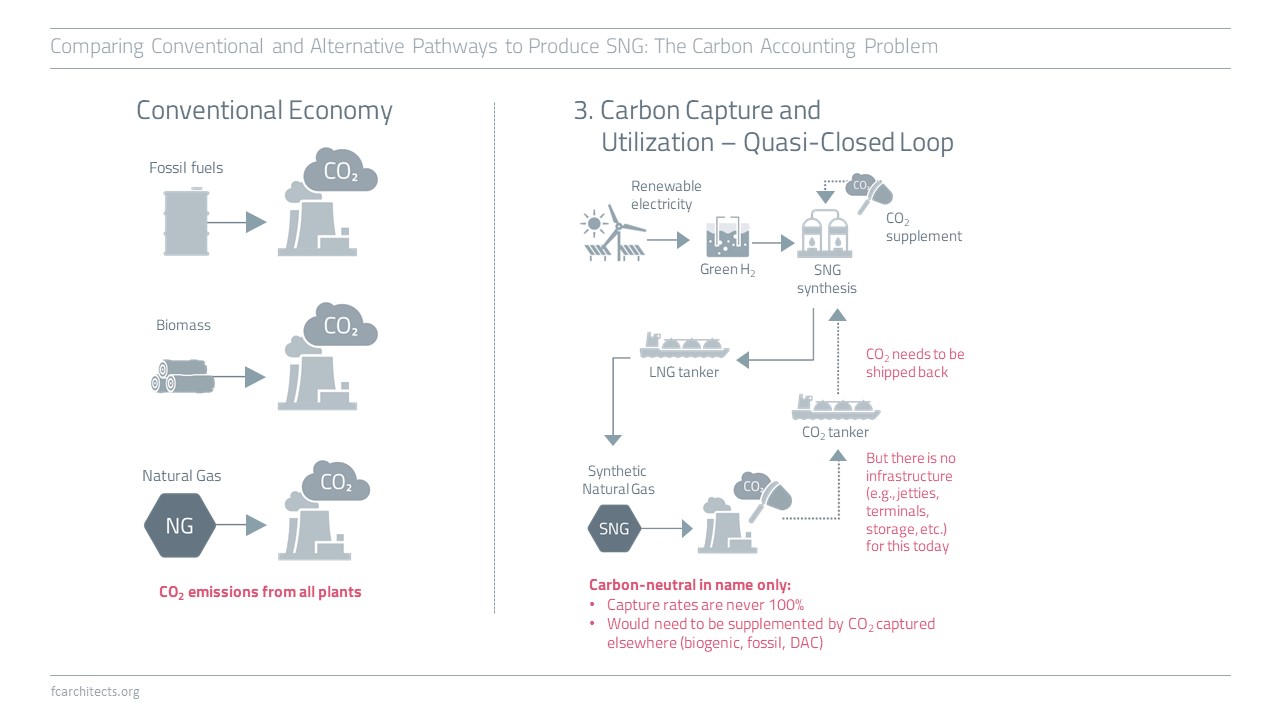

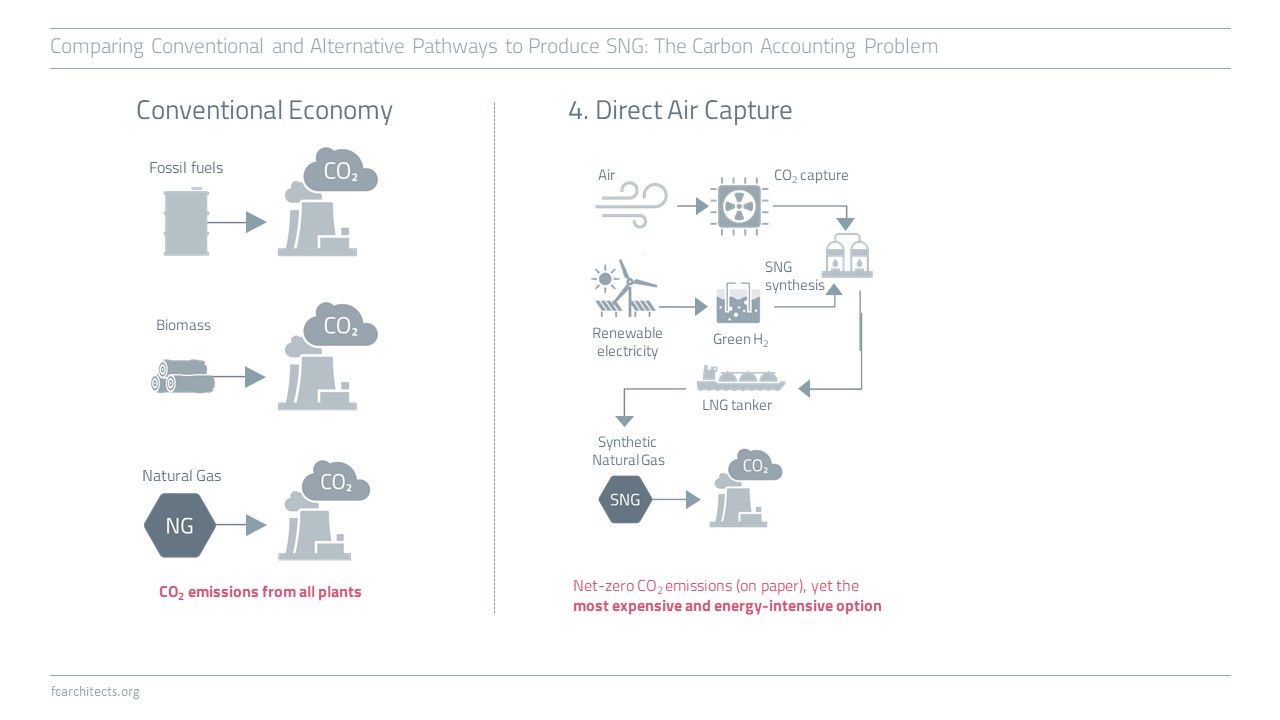

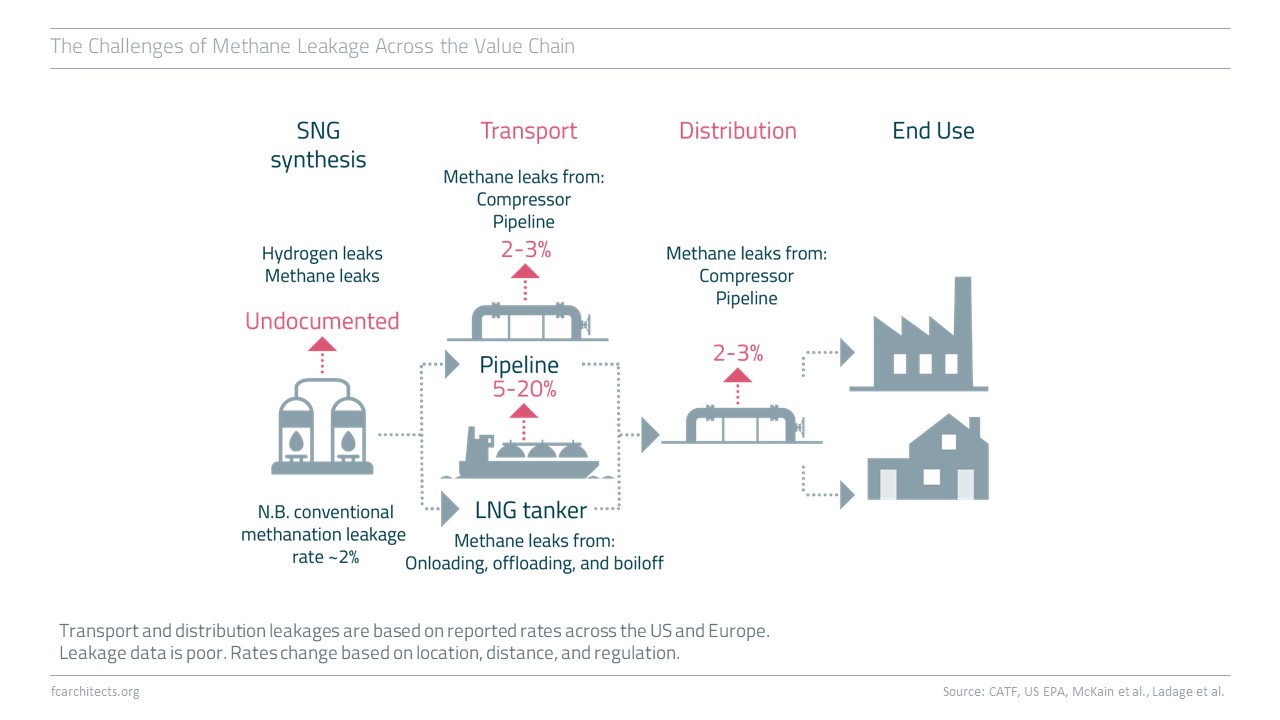

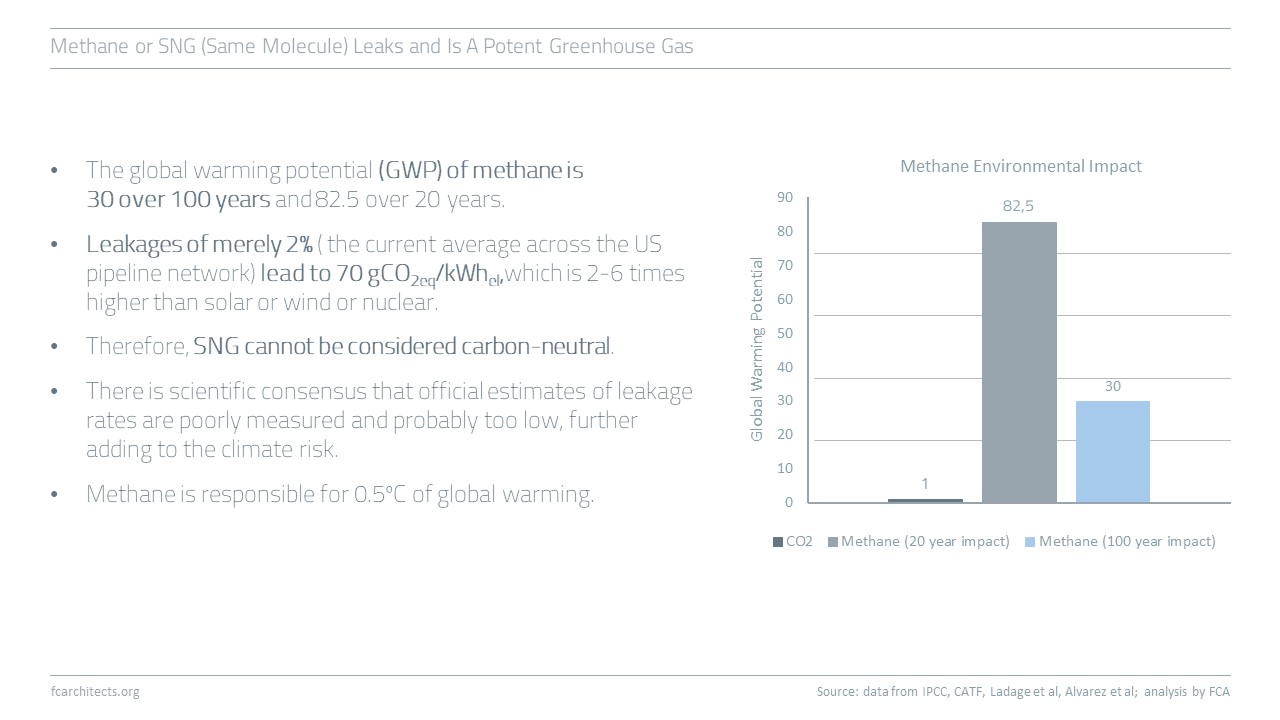

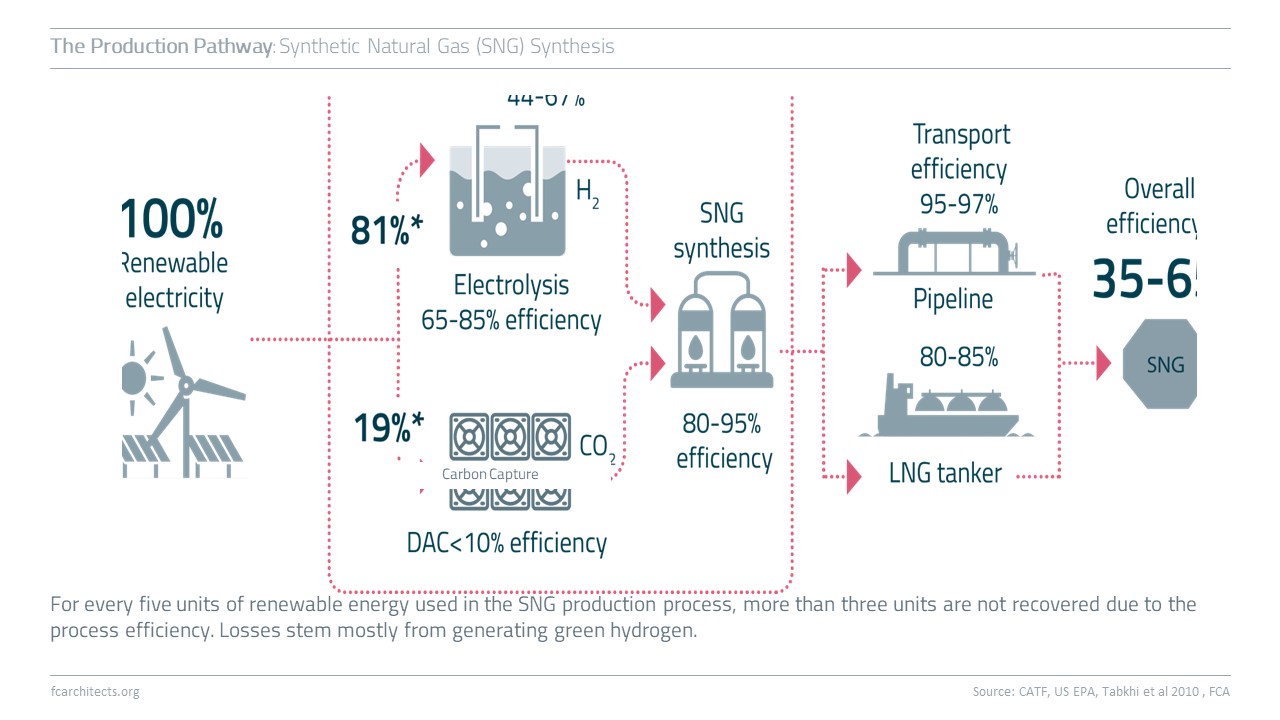

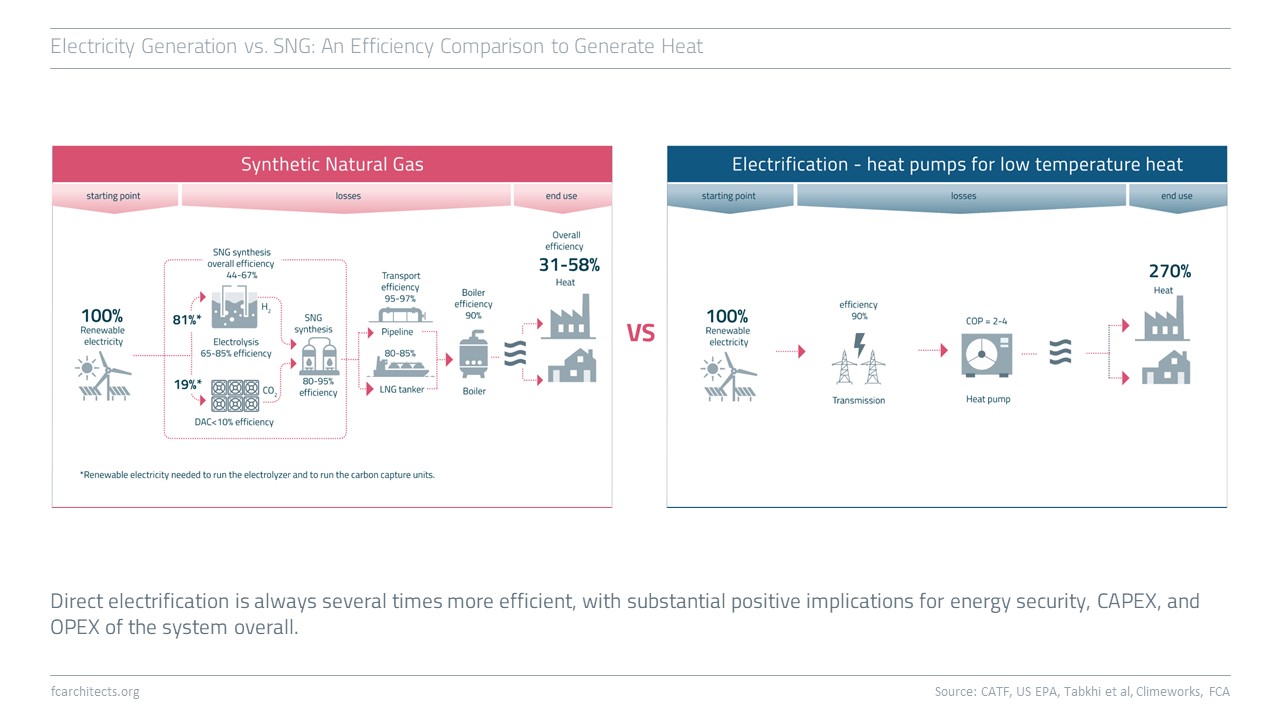

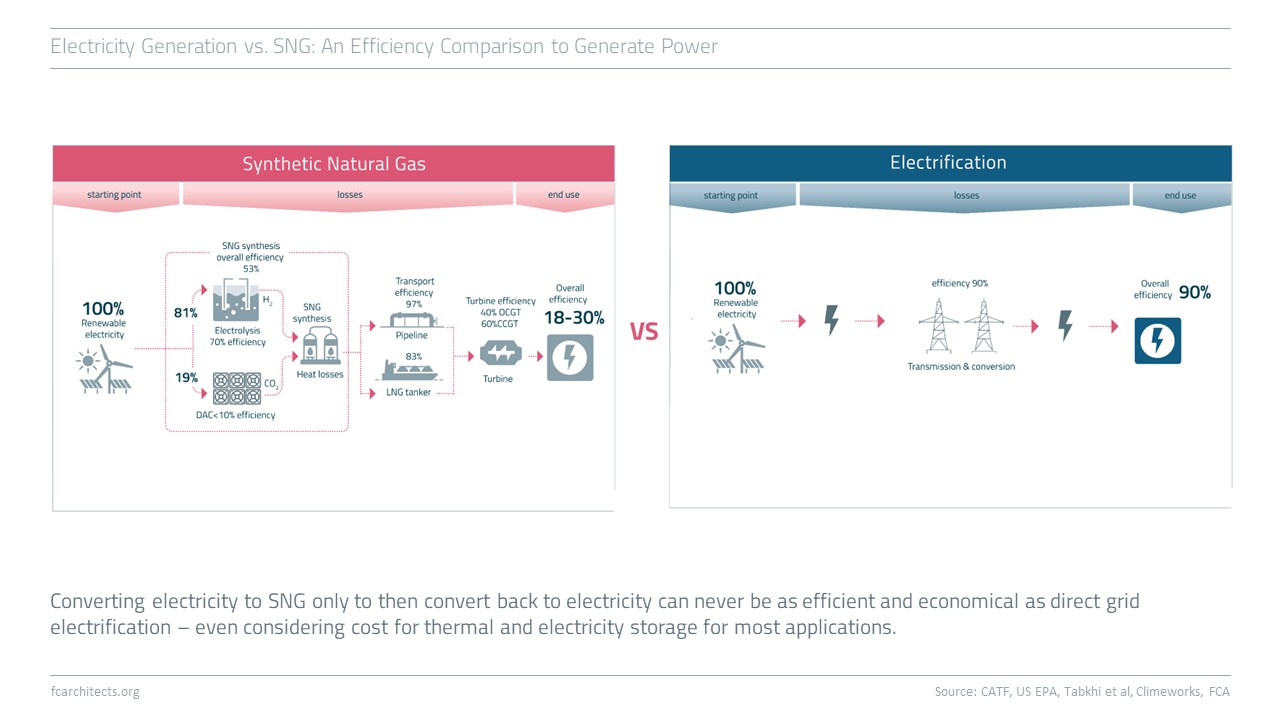

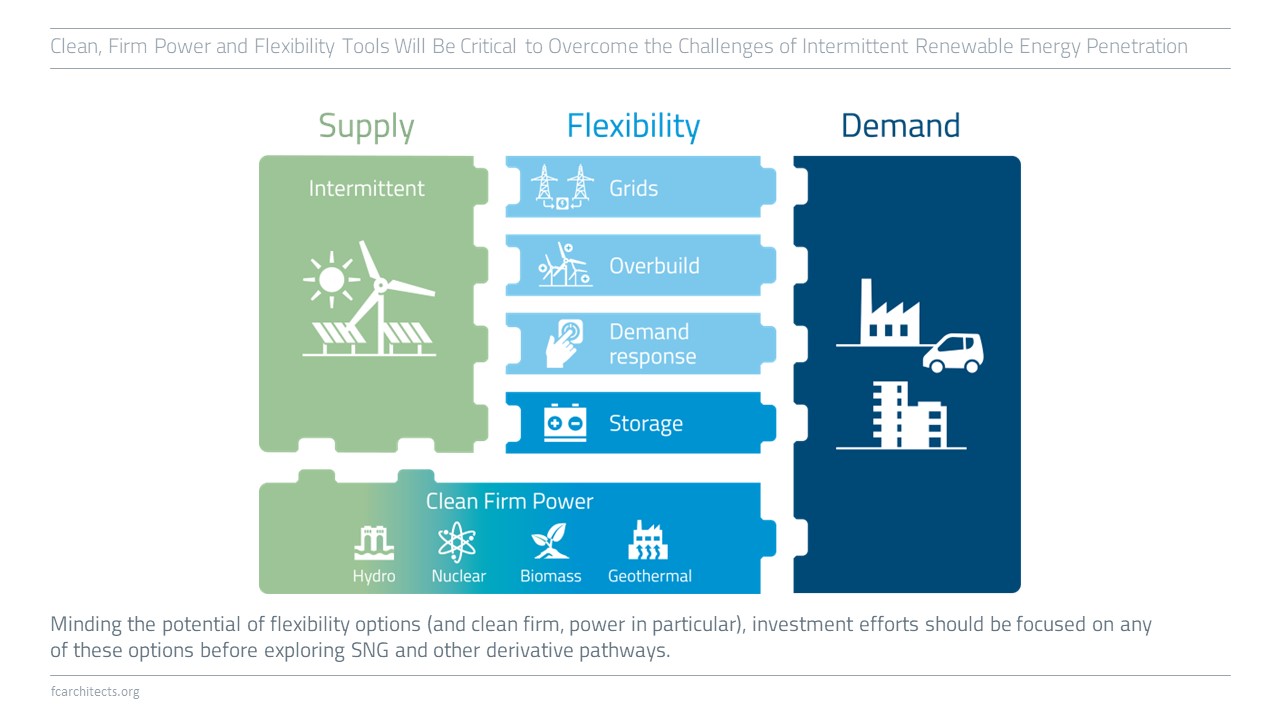

Hydrogen Derivate: Synthetic Natural Gas

As part of our ongoing project of updating our previous work on Hydrogen, we are expanding our assessment to the potentials and limitations of key hydrogen derivates.

Learn more about our assessment of Synthetic Natural Gas (SNG) and stay tuned for our full report on SNG coming soon!