FCA was pleased to outline the results of its latest project on innovation in the steel industry with a particular focus on the challenges of decarbonisation, global value chains and their transformation. The presentation took place upon the invitation of the Analysis and Research Team (ART) at the General Secretariat of the Council (GSC), for colleagues working in ART and in in other parts of the GSC. The GSC is the body of staff responsible for assisting two EU institutions, the European Council and the Council of the EU.

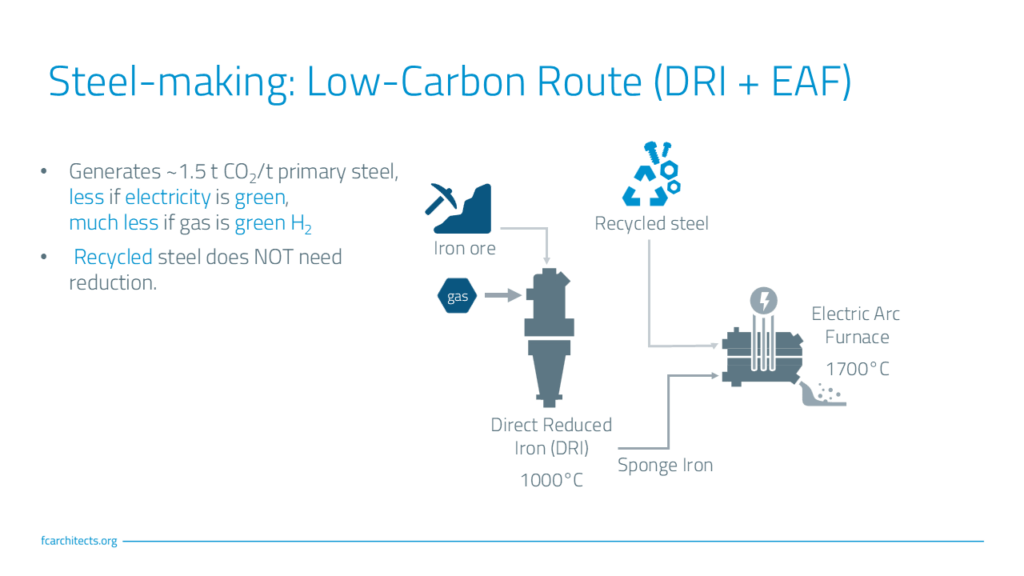

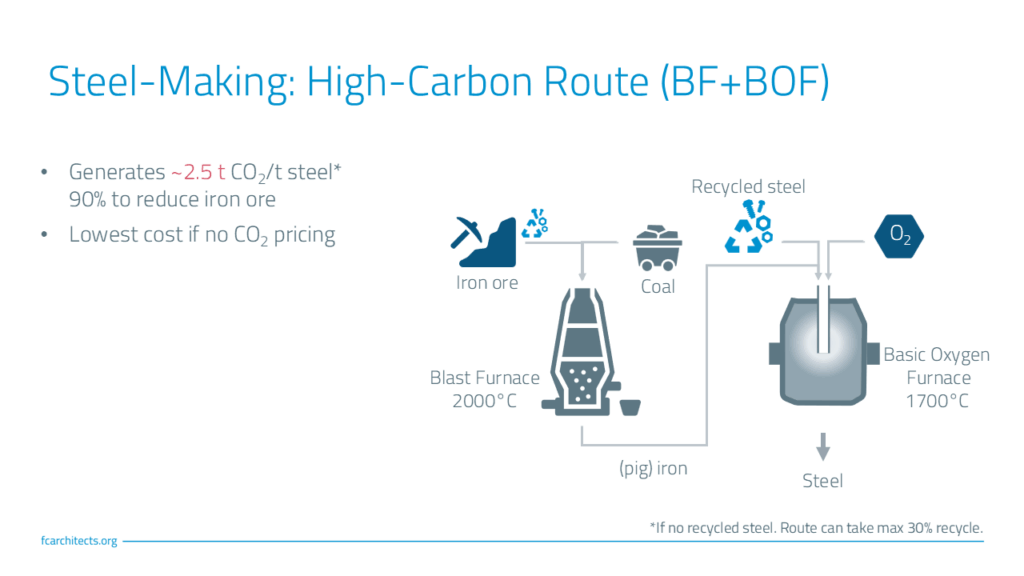

Traditionally, the first step of steel production involves reducing oxygen-rich iron ore to (primary) iron in a blast furnace using coal. This releases large quantities of greenhouse gases, approximately 2.5 tonnes of CO2/tonne of steel. In fact, the global steel industry is responsible for 7 to 11% of the global GHG (GHG) emissions, which is more than the emissions of all EU countries combined. In the second step, the iron is transformed into steel. These days, however, iron and steel do not necessarily have to be produced with coal: iron ore can be directly reduced with natural gas or hydrogen. The so-called DRI-EAF route combining direct reduction of iron ore with electric arc furnaces typically has 40% lower emissions than the traditional route. If direct reduction uses clean hydrogen and the electric arc furnace uses clean electricity, this route can lower emissions by 90% or more.

Another highly effective route to reduce emissions is recycling steel, as this omits the energy and emissions-intensive step of having to remove oxygen from iron ore. In the EU, almost 60% of all steel coming from steel mills was made from recycled material, more than double the global average.

Today, the EU is the world’s third largest producer of steel, standing at 7% of total global production. India has recently surpassed the EU to reach second place with 8%. China has been the global steel leader since the early 2000’s seeing fast growth to currently produce well over 50% of all steel. As most steel produced in these booming decades is still in use, availability of recyclable steel is limited.

Global projections indicate that while the percentage of recycled steel in steel production will gradually increase, recycled steel will only cover 50% of the global demand for steel in 2050 because of the time lag. This means that the production of new (primary) iron and steel also needs to be decarbonized, and that is where the DRI-EAF route comes in.

Multiple European steel producers have plans to use green hydrogen as a reducing agent. This, however, requires large amounts of electricity: to switch the EU’s current primary iron production to green hydrogen, it would take about as much as the 2024 electricity consumption of Spain, or 70% of all solar electricity produced in the EU.

Compared to other regions in the world, Europe’s energy prices are remarkably high. Memoranda of Understanding have been announced to import green hydrogen from regions where the conditions for solar panels or wind turbines are more favorable. But transporting liquid hydrogen is extremely challenging: it takes a lot of energy to cool the gas down to -253°C and store it in super-insulated actively cooled tanks. It would be much more efficient and cheaper if instead of importing iron ore and hydrogen, the EU imported hydrogen-reduced green iron from countries with abundant renewable electricity and good availability of high-quality iron ore. Brazil, the host of the upcoming climate conference COP-30, is one of the countries that meets these requirements. Australia is another.

As a final note, we observe that the low-emissions steel market lacks consistent terminology, which makes it difficult for steel buyers to compare products from different producers. Ideally, a universal low-emissions steel classification would be agreed upon that manages to incentivize both recycling as well as the production of green primary iron.