Blogpost | Despite progress, EU funding neglects crucial technologies for the EU to reach net zero by 2050

Written by Simon Shaw and Marlène Siméon (marlene.simeon@fcarchitects.org)

Executive Summary

- The EU’s Innovation Fund (IF) and European Innovation Council (EIC) have together committed approximately €13 billion to clean technology projects since 2021, spanning the full innovation pipeline from early-stage breakthroughs to industrial-scale demonstrations.

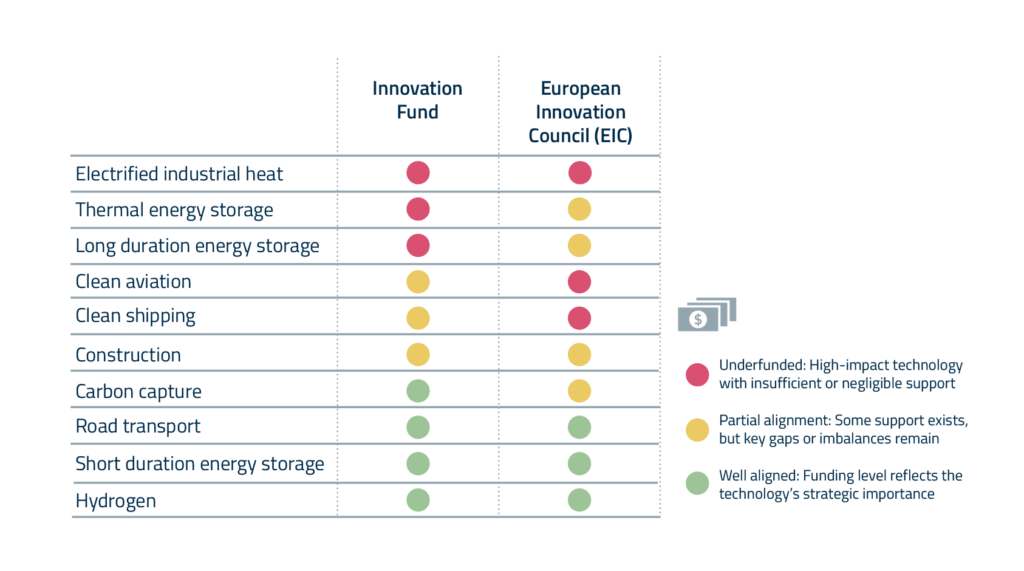

- While both programs rightly focus on high-emitting sectors and impactful technologies like renewables, hydrogen, batteries, and carbon capture, they significantly underfund long duration and thermal energy storage, electrified industrial heat, and early-stage innovation in clean aviation and shipping.

- Closing these strategic funding gaps – by explicitly supporting multi-day storage, electric industrial heat, low-carbon construction, and sustainable transport innovation – is essential to ensuring EU climate innovation aligns with net-zero goals for 2050.

Innovation Fund and European Innovation Council: the EU’s most influential funding mechanisms for climate innovation.

The Innovation Fund (IF) and the European Innovation Council (EIC) together deploy billions across all innovation stages. They have committed at least €13 billion to cleantech projects since 2021, spanning the innovation pipeline from the early R&D to the industrial-scale demonstration stage. But this funding also needs to be spent effectively on the sectors and technologies that are most critical to achieving the European Union’s target of net zero greenhouse gas emissions by 2050.

Each program plays a specific role:The Innovation Fund, financed by EU Emissions Trading System (ETS) revenues, supports large-scale demonstration projects through grants in carbon-intensive sectors. The EIC, under the Horizon Europe research and innovation funding program, uses a mix of funding instruments, including grants and equity financing, to back earlier-stage innovation through different phases of development.

Both programs are investing at scale and remain heavily oversubscribed, reflecting strong demand for EU cleantech funding: The IF, with a€40 billion budget until 2030, has already allocated almost €12 billion to over 200 cleantech projects – primarily large-scale demonstration projects of incumbents, since 2020. Meanwhile, the EIC, with a €10 billion budget until 2030, has supported more than 1,200 projects – mainly research initiatives and startups, with over €6 billion in total funding since 2018, at least €1.5 billion (25%) of which is cleantech related.

The funding largely concentrates on decarbonizing energy systems and heavy industries, which is encouraging and to a large degree aligns with the priority areas that Future Cleantech Architects identified . Yet, we find that certain technologies and sectors – such as long duration energy storage, electrified high-temperature industrial heat, innovative construction decarbonization, as well as zero-emission aviation and shipping, remain underrepresented in the current funding portfolios. These gaps point to opportunities for the EU to adjust course and ensure its climate innovation push is truly comprehensive.

Energy systems funding neglects long duration and thermal energy storage

EU funding in energy systems strongly prioritizes hydrogen and battery storage, while long duration, and especially thermal storage, remain relatively underfunded (<1% of total funding). Both the Innovation Fund and the EIC dedicate a large share of their cleantech portfolios to the broader energy systems domain. In the IF, about half of all funded projects (roughly one-third of total funding) are related to energy systems, covering areas like renewable power generation, energy storage, or green hydrogen supply. The EIC’s largest climate tech funding is concentrated in this field as well, with roughly half of the cleantech funding allocated to clean energy generation, storage, and renewable fuels.

Hydrogen is very prominent in both programs, especially the IF, representing 14% of IF projects and 16% of its funding. Importantly, most of these projects target industrial and heavy transport applications, such as green ammonia, e-methanol, or hydrogen-based steelmaking, rather than lower-impact end-uses like buildings or passenger vehicles. This mostly aligns with our recommendations in the recent Hydrogen Guardrails report, in which we advocate for targeted hydrogen deployment in sectors which are currently hydrogen dependent or where direct electrification is not viable.

But with regard to storage, funding in the Innovation Fund has been almost entirely focused on short duration batteries. Here, storage investments overwhelmingly support lithium-ion and similar technologies geared toward short-term renewable grid balancing. These investments are valuable for day-to-day grid stability, but they alone cannot ensure energy security over weekly, monthly, and seasonal timescales and must be coupled with long duration energy storage solutions.

Only four IF projects deal explicitly with thermal energy storage, and at least two others involve >12h storage durations. In other words, far less than 1% of its funding touches LDES. EIC funding shows a stronger focus on LDES, while short term battery storage still dominates. Around €200 million (~13% of EIC cleantech funding) has been directed to batteries and supercapacitors and at least €80 million (~5% of cleantech funding) towards long duration energy storage.

Key recommendation: Future funding calls[1] should explicitly broaden and increase support for diverse storage solutions, including thermal, chemical, mechanical, and seasonal systems. This is especially important within the Innovation Fund to help advance these technologies further along the innovation pipeline toward large scale deployment. LDES technologies are critical enablers of a resilient, renewables-based power system that addresses variability not only at short-term, but at daily, weekly, and seasonal scales.

Industry funding neglects technologies to electrify industrial heat

While both funding programs support industrial decarbonization to a considerable extent, funding remains heavily concentrated on carbon capture and utilization and storage (CCUS). In contrast, there is only marginal support for electrifying industrial heat at high temperatures, a key pathway for decarbonizing EU industry, as outlined in our recent technical report.

In the Innovation Fund, industry-related projects, including cement, lime, chemicals, and basic materials, represent over 40% of all projects and more than half of total funding. The cement and lime sector alone accounts for 21% of funding, while chemicals receive 14%. This prioritization makes sense given the role of heavy industry in Europe’s emissions profile.

However, the vast majority of funded solutions are built around carbon capture and hydrogen integration. Projects piloting electrified industrial heat for high-temperature processes remain rare and small-scale, including a limited number of electric furnaces in ceramics and a single demonstration of an electric steam cracker in chemical production. Electrifying high temperature processes is a key pathway to decarbonizing heavy industry and require no fundamental scientific breakthroughs, even though economic challenges remain. On the other hand, biomethane, hydrogen, and carbon capture are not always a sustainable solution for high-temperature heat processes, due largely to low availability, inefficiency, and the risk of carbon lock-in. The new pilot auction under the Innovation Fund on electrification of industrial heat will be crucial to decarbonizing heat through innovative solutions and fill this gap.

The EIC is only beginning to address construction and industrial process innovation, despite its long-term strategic importance. The program’s construction tech portfolio is small, comprising ~5% of cleantech funding, most of which focuses on novel materials and digital design rather than retrofitting or electrifying high-temperature systems. That said, two recent so-called Pathfinder portfolios on low-carbon cement and efficient construction mark a step in the right direction. In parallel, the EIC has supported over 75 broader projects categorized as climate and environmental tech, some of which target circularity and emissions monitoring.

Key recommendation: Both the EIC and the IF should more specifically gear industrial decarbonization efforts towards electrifying industrial heat, especially in high-temperature segments, coupled with thermal energy storage, a cost-effective solution for storing energy and using it as either heat or electricity, as well as alternative (performance-based) materials especially for the cement and concrete sector.

Large gaps in funding early-stage innovation for shipping and aviation

EU innovation funding pays limited attention to transport. The funding that does exist comes mainly from the Innovation Fund and targets later-stage demonstration projects for cleaner ships and planes, whereas only very limited funding from the EIC is available for research or start-up stage projects in these sectors.

Compared to energy and industry, transport receives a much smaller slice of EU cleantech funding. Only 4% of Innovation Fund projects relate directly to transport, accounting for just 3% of total funding. Much of this funding is well focused on hard-to-decarbonize segments, although prioritizing advanced biofuels besides hydrogen-based e-fuels would utilize scarce resources more effectively: Key IF projects include sustainable aviation fuel (SAF) production from green hydrogen and CO₂, e-methanol tankers, hydrogen-powered short-sea vessels, and retrofits for cruise ships to run on cleaner fuels. Further, some of the IF’s Sustainable Fuel projects are categorized within hydrogen, despite targeting the heavy transport sector.

Road transport receives limited support through the IF, which is a reasonable prioritization, given that electric vehicles already offer a mature, cost-effective pathway to decarbonize the sector. On the other hand, electrification is not feasible for long-distance aviation and shipping due to energy density constraints, thus needing alternative solutions.

The EIC portfolio tells a different story: Nearly all transport-related projects are limited to EV technologies or autonomy-focused startups, with little dedicated support for clean shipping or aviation. Its first dedicated challenge call on mobility was only launched in 2025 and is intended to support breakthrough innovation for road vehicles, waterborne vessels, aircraft, or rail. That means that the EIC is only just realizing an opportunity to advance innovation for both these critical sectors. Decarbonizing aviation and maritime will require long lead times and sustained innovation, from propulsion systems to infrastructure, and relies on support from pilot to deployment. It will be key to analyze the results of the EIC Accelerator call dedicated to mobility, which is currently open at the time of writing.

Key recommendation: Future calls under both the Innovation Fund and the EIC should more explicitly support clean aviation and maritime. These sectors require targeted innovation across fuels, aircraft design – including hybrid planes and battery innovation – propulsion, retrofits, and infrastructure. Building on the current EIC’s 2025 mobility challenge, further dedicated calls, particularly at early stages, are needed to avoid confining innovation to road transport and ensuring progress in harder-to-abate transport segments.

EU climate innovation funding: Moving in the right direction, but gaps remain

Overall, the Innovation Fund and the European Innovation Council are targeting many of the right areas — placing funding into major emitting sectors, and in some cases, like using hydrogen for heavy and chemical industry, their funding aligns well with what Europe needs for long-term decarbonization.

However, both programs have gaps in their portfolios, specifically when it comes to long duration and thermal energy storage, the electrification of industrial heat, and dedicated support for clean aviation and shipping. These areas were identified in our analysis as underfunded relative to their importance in meeting EU’s binding climate objectives. Closing these gaps will require targeted innovation support and sharper eligibility guidance within future calls. By closing these gaps, the EU can strengthen its overall innovation agenda and avoid bottlenecks on the path to net zero.

In doing so, the EU can deliver a portfolio of technologies capable of achieving net zero across all key sectors, while increasing directly related goals of economic competitiveness and energy security.

[1] Funding calls—also known as calls for proposals, auctions, or challenges—define the thematic focus and objectives applying projects must align with.

Methodology

This analysis provides a qualitative overview of how well EU innovation funding aligns with key decarbonization priorities, offering a starting point for deeper investigation. Innovation Fund data was sourced directly from the official project database, allowing for sectoral mapping and comparison by funding volume and project type. For the EIC, where no such single comprehensive project database exists, we relied on the 2025 EIC Impact Report, selected topic portfolios, and the CORDIS as well as the EU Dealflow databases, with the latter including largely EIC Accelerator projects and used only as a supplementary source. Given differing data structures and transparency levels across programs, individual project counts may carry a margin of uncertainty and are thus a limitation of this analysis, particularly regarding the EIC. Nonetheless, the broader sector-level patterns and key funding gaps identified in this analysis are supported by consistent trends across sources.